Interview: Financing with energy performance contracting. Is this the solution for deep renovations?

27.09.2022

The financing of energy saving and energy efficiency measures represents a major challenge for many WEG – service providers who handle the implementation and financing can remedy the situation. As a long-standing investor in the field of financing energy efficiency measures for apartment buildings, Nicholas Stancioff – founder of Funding for Future – knows the challenges surrounding the topic of comprehensive energy-efficient renovations in homeowners’ associations. He talks about energy saving contracting as a solution for increasing energy efficiency. A conversation about success stories.als eine Lösung zur Steigerung der Energieeffizienz. Ein Gespräch über Erfolgsbeispiele.

Kristina Eisfeld: Mr. Stancioff, you developed the BEEF model for financing comprehensive energy efficiency renovations. What is the BEEF Model and how does it help homeowners’ associations with financing?

The BEEF model is a scalable, replicable, low-risk, long-term financial instrument. BEEF stands for “Building Energy Efficiency Facility”.

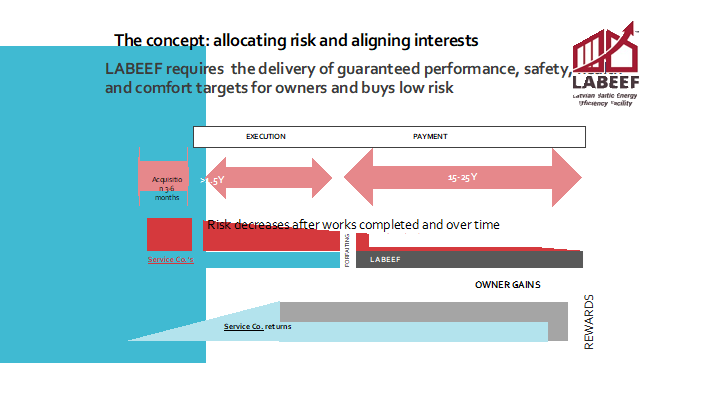

The fundamental purpose of the concept is to scale up dEEp (“deep Energy Efficiency priority “) renovations and produce long-term benefits for owners while lowering risks for property owners and financiers. BEEF’s primary innovation (and disruptor) is that it separates the risk of poorly completed work (which is the builder’s risk) from the risk of collecting payments. The risk of poorly completed work (performance risk) is further reduced by long-term guarantees of savings and of quality of works.

There is nothing that can be done to control the risk of inadequately completed work (performance risk). As a result, the Builder must fund its own work – the risk remains with them. Owners, on the other hand, do not have the same flexibility: if they do not pay, a number of negative events follow. As a result, it is doubtful that they will not pay. Also, because this payment is part of the utilities, they can sell or rent to a third party who will make the payments. Finally, the guaranteed results further improve quality further ensuring that payments will be made. This structure explains why such buildings are in high-demand and command a 20-30% premium in the real estate market.

By definition, service companies must be excellent at delivering services throughout the contract with their clients. Any problems are their responsibility to manage. These potential risks are theirs to manage and should not burden clients or financiers.

However, payment risk is not the responsibility of the service company. This belongs to owners/residents. The BEEF takes the payment risks.

Better risk allocation lowers the total costs to the owner. While the short-term money needed to deliver the project will be more expensive, the longer-term repayment will be far less costly as the risk is lower.

Evidence in Europe and the US supports owners’ payment discipline. The LABEEF experience – LABEEF is the BEEF in Latvia – is 100% payment -95% in 30 days. In the US, defaults on renovated homes are 32% lower than the market.

Kristina Eisfeld: Why did you develop the BEEF model? What challenges is it addressing?

Building retrofitting is a difficult task. It involves many technical concerns and many players, each with their own point of view and interests: energy specialists, architects, building businesses, engineering offices, site managers, banks, political decision-makers, subsidy programme implementers, and so on. What is frequently lacking is an experienced and committed central coordinator who acts on behalf of and for the HOA.

A further complication is that homeowners’ associations are not homogeneous groups and joint decision-making is correspondingly challenging. Different perspectives and interests of the owners have to be taken into account, otherwise it is easier to leave things as they are. It is necessary, especially in the case of large investment decisions, to moderate the decision-making processes in the HOA.

Since then, I have always asked myself how could Energy efficiency in buildings be developed as a real business. There are billions of square meters of multifamily buildings that must be renovated. These buildings are between 40 and 70 years old. The potential saving from these buildings is far above the 30% savings the EU targets today. Energy neutrality is conceivable.

Residents are reluctant to commit to dEEp renovations and it seems that challenges are impossible to overcome. To name the main ones:

- Few understand the real meaning of the Energy Efficiency First principle.

- Many do not understand the amount of deferred maintenance in housing.

- Almost none has calculated the consequences for the building’s and the resident’s health.

- Owners will typically choose short-term over long-term.

- Each renovation is a repeat of the same mistakes.

Today, the culture is changing. We have “EE First Principle” but there is still much to do. We designed one possible model.

Each aspect of the model addresses one or more of the challenges. It includes the need for long-term and monitored guaranteed energy savings (1). Its guidelines require structural soundness (2) and include specific measures regarding building and occupant safety and health of the indoor and outdoor environment (3). The contract requires 20 to 30 year services, while the owners may want to skimp on these, the service company must perform them (4). By freeing the Company’s cash, companies can repeat the same model going down the learning curve (5). The BEEF lays out the entire process starting with the end in mind: successful projects are 90% preparation and 10% execution: companies can focus on what they are good at delivering technically and monitoring the results to the satisfaction of residents (6). The opportunity is vast (7).

The homeowners get what they need: Safety, Health and Comfort. The Service Company delivers what they are best at: services based on a technology they control, and the Financier handles the payment risk. Society gains from a cascade of benefit: better well-being, higher employement, lower balance of payments, high energy security.

Final entangled challenges that needs addressing: owners lack liquidity and the urgency increases the need for rapid escalation of renovations rates. By drawing cash into the housing infrastructure, the BEEF increases renovations rapidly in an asset class in urgent need.

Kristina Eisfeld: Describe briefly how the model works and the role of the participants in the preparation and implementation of the project.

Before any activity, the BEEF seeks funding based on legal, financial and technical Guidelines. The Guidelines require guarantees on Energy Savings, meeting CO2 targets, safety and health criteria. They also include the protocols and methodologies for accounting and settling results. Financiers only disburse through the BEEF based on results that match these Guidelines.

Once the BEEF has secured financing, it publishes the availability of funds and the core Guidelines to be met. Services companies can self-select and, in turn, attract clients based on the eligibility section of the Guidelines.

Once the Company and the client prepare jointly the project and enter core data, documentation on a digital platform, the Sunshine platform, the BEEF team will provide a commitment subject to

- initial funding from the Company’s commercial bank

- design and planning demonstrating the proper execution of the works and testing.

The companies would receive short-term capital from their bank based on their expertise and the commitment of the BEEF to purchase the future receivables.

With funding commitments in place, which may be blended with grant components, the service company can execute the renovation works.

Following commissioning, the project is submitted to a testing period – in Northern Europe, the heating season. After the testing period, an independent confirmation of savings, quality of works and administrative compliance (such proper insurance) would trigger a payment of no less than 80% of future receivables to the company.

The BEEF purchases the receivables. From then on, the company would be responsible for the services and receive a quarterly payment for this work and the balance of its share of the receivables, while the BEEF would collect the funds from owners/residents as part of their utility bill. In many cases, the housing management company would collect these funds as well as provide outsourced maintenance service.

Kristina Eisfeld: The BEEF does not provide the initial funding; it forfeits the final production?

Yes, the BEEF is purchasing the future invoices for services rendered over the next 20-30 years. The service provider will be delivering these services thanks to the initial investments they have made in the building and the energy systems of the buildings.

Following confirmation that the works achieve the above-mentioned targets, the BEEF will “buy” future services from the service company.

Kristina Eisfeld: Do buildings need to be a specific size to be eligible?

Today we focus on multifamily and public buildings for two reasons. Firstly, the 80/20 rule: we can deliver CO2 savings faster by concentrating on the biggest and worst.

Second, larger buildings provide for higher profit margins for the contractors. Proven quality outcomes will promote market expansion and scale. Companies will need a gross margin of at least 15% on each project. Today, large ESCOs will not consider a project with a gross margin of less than 20-25 percent!!

In the second stage, upon reaching scale and market maturity, the market actors, having gone down the learning curve, will naturally take it upon themselves to further widen their opportunities based on the evolution of product offerings and pricing.

Kristina Eisfeld: What kind of renovation projects does the BEEF require?

BEEF requires specific technical targets covering building engineering, indoor environment, and safety.

The Guidelines do not impose any methodology, only the targets to be met and the protocols to demonstrate fitness requirements. In addition, the Guidelines provide a method that the companies can repeat and lower their delivery costs.

Finally, with the information across several BEEFs, advisory boards can “tweak” the Guidelines annually to further increase quality while controlling costs.

Kristina Eisfeld: Which advantages does BEEF offer the contracting parties involved?

The primary advantages are scale and reduction of costs. The low rate of dEEp renovations makes it urgent to increase scale. For any scale to occur, all stakeholders must benefit so that they will engage.

For this to happen, owners/residents must perceive a clear and benefit to the renovation.

For the owner to see an tangible benefit, we align the interests of all stakeholders on the final beneficiary.

However, the advantages are to all the parties. The first advantage is a more straightforward, more precise way of dealing with one another. Thanks to the Sunshine platform, each counterpart enters critical information standardised. The platform reduces information asymmetry: it allows owners to have the same information, financiers can check for trends, and the companies can demonstrate their results. Independently run by an NGO, it provides trust in the quality of the information.

The goal of the BEEF is to reduce the transaction and management costs throughout all project phases, including monitoring. Today, retrofits are one-off projects. Project finance teams analyse these. These assessments require the same work as for a significant greenfield industrial project. The five-floor building owner(s) will pay much higher transaction fees per euro invested than the major greenfield project. While it will pay more in transaction fees and interest, it will not receive the same quality review.

Our standardised process will also reduce the time for decision-making initially: decreasing marketing costs while increasing positive decisions. In Latvia, after an initial 2 buildings over three years, over 17 applied in the same neighbourghod over the next 2 years. During the project, the shorter documentation preparation and monitoring lead times provide savings to the company.

Finally, the standardized approach implies that commercial banks can provide more support faster and a lower cost.

As the BEEF closes many standardised contracts, contracts can be further aggregated and sold as a block for new liquidity.

Kristina Eisfeld: What is the role of Funding for Future in the BEEF concept?

F3’s mission is to meet the climate crisis: CO2 reduction and the social problem: lack of housing. One fits neatly into the other.

“There is no money for projects”, say the companies, “There are no good projects!”, say the financiers. To address the “chicken-egg” problem of renovations, F3’s goal is two-fold:

1- provide a steady return to investors on par or lower than a utility. This comparison is logical: BEEFs are financing Energy – megawatts.

2- the setup of the BEEF, the sharing of know-how and the delivery of a multi-country platform to track projects and contracts. Guidelines and their annexes must evolve and learn from other BEEFs.

BEEFs need little staff and have minimal overhead: accountant, audit, legal and provisioning.

Kristina Eisfeld: Can you give some insights into concrete examples in Latvia?

In Latvia, LABEEF has purchased bonds based on the contracts of six buildings meeting the Guidelines.

The challenge was finding a way forward in an environment that doesn’t have extensive experience in financial instruments because of shallow capital, and real estate markets.

LABEEF can be considered a comprehensive pilot test resulting in an number of replications, the largest is Poland’s. However, it is also a good practice to test all aspects of any financial instrument:

- analysing the technical, economic, and legal aspects,

- structuring the legal aspects of the instrument,

- attracting the necessary financing,

- purchasing receivables,

- managing the fund

- and closing it.

Poland has now replicated LABEEF. NFOS – the government’s environment and wastewater fund launch a priority program – EPC PLUS. Slovakia and Romania are preparing versions.

Meanwhile DG Regio and EIB recommend it as a model for policy makers. [https://www.fi-compass.eu/content/innovative-forms-integrated-building-renovation-services]

Kristina Eisfeld: What framework conditions are required for the model to be implemented?

Before any project, before seeking funding, the BEEF guidelines must comply with local laws. Technical targets for safety, health, and comfort must be defined.

Thanks to existing studies and our own research in Austria, Slovakia, and Poland, we conclude that Germany would not require a heavy legal burden to develop the BEEF framework, meet the homeowners’ associations rules and regulatory requirements: quota, votes, invoicing etc.

Our partners in Green Home would be the ideal champions to move the instrument from concept to reality.

Kristina Eisfeld: How could the BEEF model be transferred to Germany and be applied here? Will this require special knowledge?

It does not require any special knowledge.

The BEEF model requires to use of its Guidelines and follow the methodology already tested in several countries including Poland and 4 other countries. The project must meet technical targets while owners/building and Company must meet sound eligibility requirements. The Guidelines annexes include the legal documentation necessary: the EPC Plus, the Transfer documentation, and Maintenance Agreement/Manual. In addition, templates and instructions for all parties support the Guidelines.

The Guidelines dictate the minimum targets that must be achieved to deliver a dEEp renovation for the building (including maintenance).

The BEEF Guidelines cover the contractual processes of a dEEp renovation. The instrument lays out before the project’s design, each party’s responsibilities, and what will happen. In addition, it provides documentation and procedures before and after the contract’s duration.

In other words, the targets to be reached during the service contract are predetermined and non-negotiable, the international protocols for verification are unambiguous, all the steps are standardised, and contractual templates are in place. Furthermore, this information is publicly available. As a result, the Service companies know their risks and how best to mitigate these. Therefore, the housing association has confidence in their agreement.

So no, no unique know-how is necessary.

From your point of view and extensive experience, can ESCOs contribute to increasing the Renovation Rate in homeowners’ association buildings?

ESCO have extensive experience in working in a systematic and structured way. They are accountable for the savings they provide.

ESCOs are currently reluctant to modify their business model as

- it focuses on technical solution they can provide themselves and avoids the complexity of a dEEp renovation – more profitable.

- most contracts are with authorities or industrial clients is that ESCOs don’t want the difficulty in closing transactions with homeowners – less costly.

We propose that the EPC+ – which provides a complete refurbishment and services for the next 30 years offers a less costly and more profitable way forward for the long term due to the replication and scale.

Which is why, in the previous question, I refer to service firms rather than ESCOs. BEEF model establishes an organised environment, allowing SMEs to enter this industry. Their technical expertise and project management abilities would be required. They would not need a large corporate entity to provide all of the additional know-how required, principally financial and legal, which is currently a natural barrier to market entry. According to our research, upper management spends more than 20% of project expenditures on documentation and contractual management.

What will energy retrofits look like in the EU? What are the significant challenges and barriers to renovations? Do you have any recommendations for market actors in the financing, building management and energy service companies?

The Future is now. The Commission states that Europe is at a 1% renovation rate. However, this rate is misleading as deep renovations are less than .25% annually.

We need 3% renovation rates at least. We must talk about deep retrofits financed from Energy Efficiency Savings with 25-30 years payback times.

A coherent set of long-term regulations would remove the main challenges and barriers I mentioned earlier.

So, the main recommendation is for local authorities to support models whose benefits ensure an increase in the real estate value for owners – this implies a deep renovation has been carried out. Financing institutions will have greater security. In turn, they will finance large projects. With more similar projects, service companies will benefit from better margins and profit from higher value proactive maintenance contracts.

Further, the policies must include monitoring and guarantees regulations.

Finally, these policies must stay in place for the next 10-20 years.

This way, companies and SMEs will invest in assets and train a permanent workforce instead of following the boom-and-bust pattern encouraged by EU structural programs.

Simultaneously, dEEp renovations unlock a cascade of benefits to residents and the State.

Increased revenues, increased jobs, lower health costs.

Until this is in place, there is little to recommend to the market actors as they know better than I what slim margins they struggle for in delivering current renovations.

Currently, policies don’t:

- meet the immediate future needs of these buildings and their residents: Compatibility with autonomous vehicles, for instance.

- consider the increase in the frequency of “extraordinary events”, the so-called 100-year weather events. These are now occurring on a 20 to 50-year basis. This cycle will shorten rapidly to 15-to 25 and then to 10-15, a pattern we see already, for instance, in California, and elsewhere.

Check out this link from NASA – be patient, it illustrates our reality forcefully.

The policy recommendations are essential, but we must overcome negative behavioural patterns. These can take the general forms of “NIMB” -not in my backyard, “2B2K” -too busy to know, Not on my watch, or the worst: “let the next generation come up with the solution.”

We need more champions and first movers to catalyse this change.

Together, we can deliver, not just imagine Climate-neutral, Climate-resilient European Housing.