Climate neutrality in multifamily buildings by 2045 -What is the status quo in homeowner associations?

The goal of a climate-neutral building stock by 2045 is ambitious and cannot be achieved without homeowners’ associations. The refurbishment rate of multifamily buildings owned by homeowner associations (HOAs) is well below the national average, and regarding the revision of the Energy Performance of Buildings Directive (EPBD), a tightening of the energy efficiency requirements by the legislator and increasing pressure on HOAs to act is to be expected.

In April and May 2022, the Germany-wide GREEN Home online survey with property managers and homeowner associations assessed the perspective of homeowners and property managers on the status quo of multifamily building renovations in Germany. The aim of the two surveys was to uncover citizens’ investment motivations to support energy-efficient renovations and barriers responsible for the renovation backlog. Particularly, the objective of the survey was to shed light on which points can be used to provide better support for corresponding renovation projects, e.g. by redesigning financing instruments, providing information for investment decisions to be made and transferring knowledge. The analysis is based on the answers of 63 owners and 78 building managers. Additionally, the research team reviewed additional current studies to enrich its analysis.

Building Stock – poorly perceived

The survey showed that the age distribution of HOA buildings is almost identical to the age distribution of the total residential building stock in Germany (BBSR 2014). 60% of the buildings were built before 1979 and therefore offer high energy saving potentials, being built before the first Thermal Insulation Ordinance (WSchV 1977). In HOAs the refurbishment rate is significantly below average, and the overall refurbishment rate of 1% in Germany is far below what is needed to reach a climate-neutral building stock by 2045 (Galvin 2014). According to the GREEN Home survey, in the last five years renovation works were done only in 31% of buildings.

Pressure to act, awareness and willingness to invest

More than 90% of the participants from both target groups perceive stricter legal refurbishment requirements in the coming years. The majority of owners (90%) actively advocate that instead of simple repair work, energy-related refurbishment be carried out if this is economically viable. Above all, the increase in energy prices motivates owners to carry out extensive renovation measures. Over 90% of homeowners are willing to invest more money in energy-related measures. Only 10% of owners do not want to do this.

The Financing gap – often the first perceived obstacle

Perceived reasons for lacking investments of homeowners in renovations are mainly of financial nature. Other surveys identified long amortisation rates of energy efficiency measures, costs surpassing the financial capacity of homeowners and HOAs missing access to capital as the leading barriers for homeowners to renovate (BBSR 2014). The GREEN Home survey adds a lack of information about the building’s need for renovation and legal requirements (66% agreement) and missing renovation and value preservation planning (52%) to this list of most seen barriers.

Motives and barriers – the property manager’s perspective

For property managers, the main barrier is the missing economic viability due to the common financing term of ten years being too short (68%). There is an urgent need to raise awareness of the topic: 68% question the sense for implementing energy efficiency measures and 62% state that maintenance reserves of HOAs usually are too low. However, property managers generally agree that climate protection is relevant for building management (92,5%) (VDIV Weiterbildungsumfrage 2021).

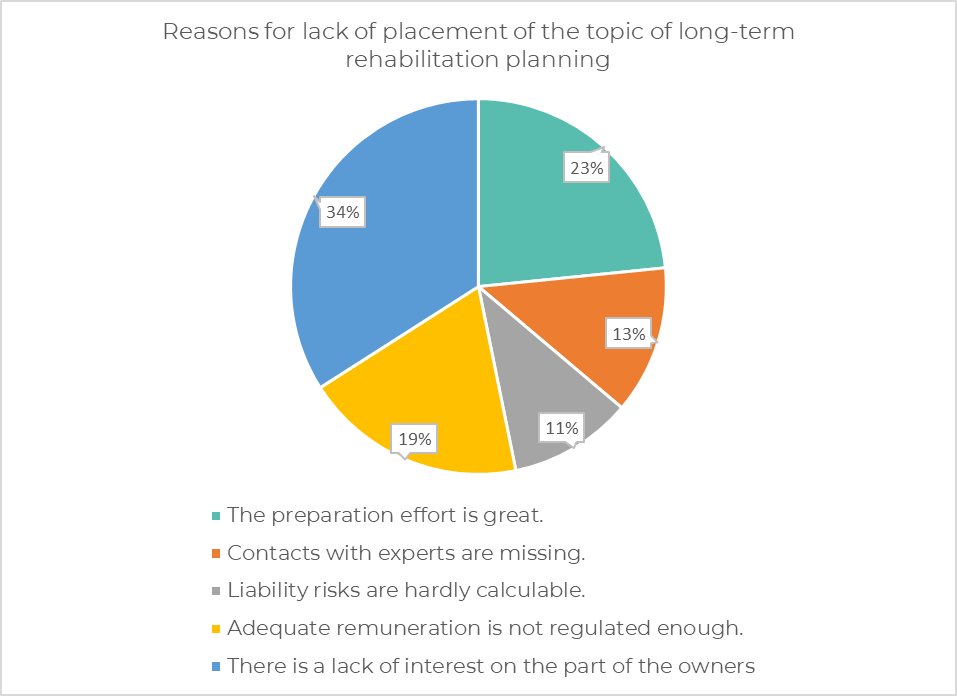

42% of the HOAs complained that their property management company did not sufficiently address investments in energy efficiency in the case of renovations that were necessary anyway. As reasons for the lack of long-term planning of value retention and refurbishments, property managers mentioned the following aspects: high preparation effort (61 %), lack of interest by homeowners (78 %), low staff capacity (50 %) and too low remuneration (50 %).

Motives and barriers – the homeowners’ perspective

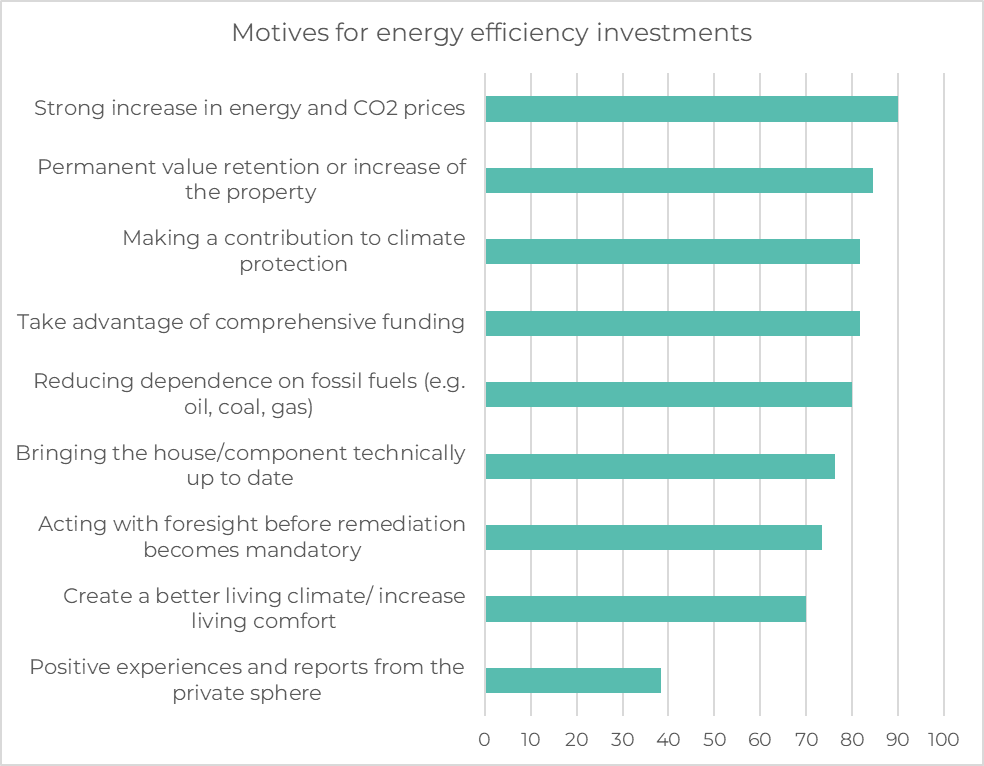

While financing seems to be a major problem for homeowners, they also see the financial benefits of renovations. 90% agree that rising energy costs are a motive for comprehensive renovations. Continuous value preservation as another reason (84%) is followed by contributing to climate protection and taking advantage of comprehensive subsidies with 82% of homeowners agreeing to each.

The information gap, is it the key?

The question arises, what information and financing instruments do homeowners and building managers need to make the decision to renovate. The survey showed that informational materials are needed about subsidies, financing opportunities, legal requirements, cost savings, and suitable renovation measures for different building types.

How to fill the gap?

Especially renovation roadmaps were identified as much needed, but not yet established, decision-making aids. In the survey, 95% of owners agreed that renovation roadmaps could be an instrument for calculating short-, mid- and long-term investments. They create transparency about what measures are needed and should provide a holistic picture of needed renovations (93% agreement).

Further widely agreed upon values are:

- Means of argumentation to increase the maintenance reserve

- Enabling the coordination of individual partial renovations

- Aid in planning financing and making investment decisions

- Moderation aid in decision-making processes

- Consumer protection information when purchasing a condominium

Individual renovation roadmaps must include holistic planning, which also takes into account electrics, pipes and all other components, according to the opinion of the majority of owners. However, it is crucial that property managers place the topic of long-term renovations in the homeowners’ meeting ahead of time, because according to 87 % of the homeowners the topic is being discussed when there is an acute need for action. At this point, there is often no longer enough time to consider and plan a comprehensive renovation.

The federal government has also recognised the potential of individual renovation roadmaps. According to the current coalition agreement, they should be used systematically, but above all, they should be created free of charge for HOAs.

Apart from information, suitable financing instruments are much needed for comprehensive building renovation, as the analysis of barriers showed. Maintenance reserves play the most important role in renovations in HOAs (67% of renovations), indicating the importance of increasing the amount of reserves. Other typical sources of finance are individual contributions by homeowners (33%), HOA-loans (5%) and subsidies (9%).

A majority (60%) of owners are willing to take a long-term loan for 10 to 15 years for comprehensive renovation works if the loan costs are covered by the energy savings. 20% are undecided, while 20% refuse to take out a loan.

Single-source solutions anyone?

Building managers (97%) see the usefulness of comprehensive third-party services (e.g. in the form of Energy Performance Contracts) that cover financing, subsidisation, planning, implementation and continuous maintenance. Government aids and subsidies are considered to be insufficient by building managers. 71% think better subsidies would increase the renovation rate. On average, the application process for current subsidies is rated as poor (32.5%) rather than good (13%).

Climate neutrality can only succeed together

Property management companies play a key role when they educate HOAs about the need for renovation to maintain the value of their property. That’s why they know what’s missing and where there is a need: Development of financing concepts (51 %), counselling services (91 %) and online information platforms (88 %) together with regional information/ counselling centres (90 %) received the highest approval ratings from property management companies. Regional contact points, which act as one-stop-shops, can be used by administrations and HOAs. They offer energetic refurbishments “from a single source”, e.g. they provide support with advice, the selection of options and suitable financing instruments, and project implementation. Nationwide information points, however, were regarded as “not useful.” Could this be demonstrating that residential renovations are a case of “Think Global but act (very) Local?” For both, owners and building managers, the use of their personal and professional networks, apart from websites of interest groups and consumer protection associations, are the main sources of information about building renovation.

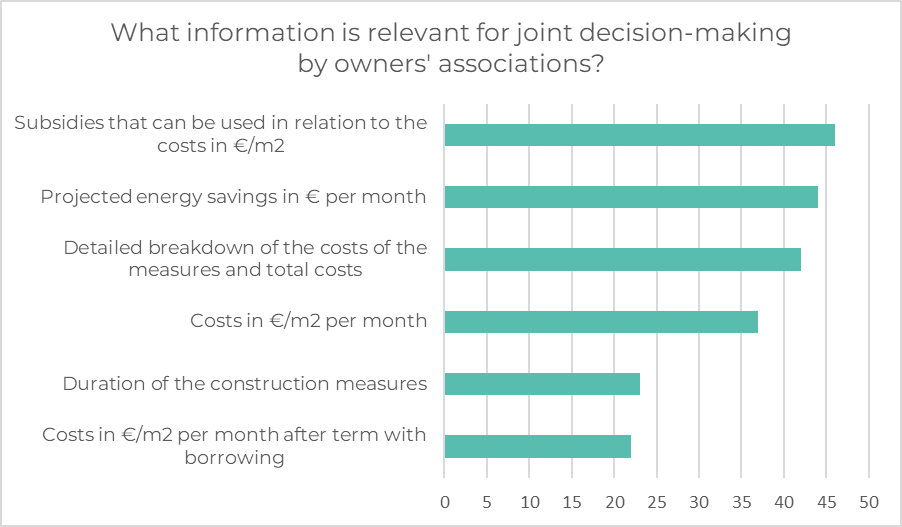

What information is relevant for joint decision-making by homeowners’ associations?

Reaching the necessary majority in the homeowners’ meeting is a particular hurdle, especially when all apartment owners have to bear the costs of the energy-related renovation measures. Only well-informed owners are willing to invest the necessary capital. For this, different types of information are necessary for the joint decision-making in the HOAs: most frequently mentioned was information on subsidies that can be used in relation to the costs in €/m2 and the predicted energy savings in € per month.

Above all, information on funding/subsidies is considered particularly important (98%). Also, the current legal minimum standard/specifications for residential buildings (91%) and the transparent presentation of cost savings per residential unit (m2) for renovations (90%) are the three most frequently mentioned pieces of information.

Additional information

Project deliverable: Stakeholder survey

BBSR [Bundesinstitut für Bau-, Stadt- und Raumforschung im Bundesamt für Bauwesen und Raumordnung] (2014): Investitionsprozesse bei Wohnungseigentümergemeinschaften mit besonderer Berücksichtigung energetischer und altersgerechter Sanierungen. Bonn: BBSR. https://www.bbsr.bund.de/BBSR/DE/Veroeffentlichungen/Sonderveroeffentlichugen/2014/In-vestitionsprozesse.html?nn=445354.

Eisfeld, Kristina (2022): Woran liegt’s? Eine GREEN Home- Befragung von Eigentümergemeinschaften und Verwraltungen ermittelt Hürden für energetische Sanierungen. VDIVaktuell 05-22.

Galvin, Ray (2014): Why German homeowners are reluctant to retrofit. In: Building Research & Information 42 (4), S. 398–408. https://doi.org/10.1080/09613218.2014.882738

Pfeffing, J. (2021): Welches Know-how ist gefragt? Das ergab die diesjährige Umfrage des VDIV Deutschland zum Bildungsbedarf der WEG-Verwaltungen VDIVaktuell 8/21. Online verfügbar unter https://www.archiv.ddivaktuell.de/blog/welches-know-how-ist-gefragt-das-ergab-die-diesjaehrige-umfrage-des-vdiv-deutschland-zum-bildungsbedarf-der-weg-verwaltungen, zuletzt geprüft am 30.06.2022.